IDBI Bank: How To Become Financially Free And Secure. IDBI Bank, officially known as the Industrial Development Bank of India, is a prominent Indian financial institution.

Through the years, IDBI Bank has developed and expanded its operations to become a full-service commercial bank. The purpose of this article is to introduce IDBI Bank’s diverse offerings and services in more detail.

IDBI Bank

IDBI Bank is a leading financial institution in India, known for its extensive history and wide variety of banking products and services. Here are some important highlights about IDBI Bank:

- Establishment and Ownership: It was established in 1964 and is owned by the LIC and the Indian government.

- Products and Services: Provides savings accounts, loans, credit cards, insurance, and investment services.

- Internet Banking: Secure online banking services allow you to access your accounts and make transactions at any time, from any place.

- Customer Care: Customer satisfaction is a top priority, and dedicated helplines are available to assist customers.

- Social Media Presence: Engages customers on platforms such as Twitter, Facebook, and LinkedIn.

Read Also: Meezan Bank: Explore Islamic Banking Solutions

IDBI Mobile Banking login

IDBI Bank provides a convenient and secure mobile banking service, enabling users to conduct transactions and manage their finances anytime, anywhere. Here’s a comprehensive guide on how to log in to IDBI Mobile Banking:

- Go to the app store and download the IDBI Bank Go Mobile+ App.

- Create a PIN or password for mobile banking by providing your account details.

- Log in to the app by entering your User ID and PIN/password.

- Mobile banking features include checking balances, transferring funds, and paying bills.

IDBI Bank Is Private Or Government

IDBI Bank has been classified as a “Private Sector Bank” by the Reserve Bank of India (RBI) since January 21, 2019. Although it was initially founded as a government-owned financial institution, its ownership structure has evolved over the years.

IDBI Net Banking Generates Online Password

With IDBI Net Banking, you can manage various financial activities like checking your account balance, viewing transaction history, transferring funds, paying bills, and more. Here’s a simplified guide to generating an online password for IDBI Net Banking:

- Please visit IDBI Bank‘s official website.

- Go to the “Personal Banking” section and click on “Login“.

- Find the option to create an online password.

- Verify your Customer ID by entering it and following the instructions.

- Create a temporary password and submit the information.

- Create a new password based on the criteria provided.

- Make sure the new password is correct.

- Use your Customer ID and new password to log into IDBI Net Banking.

IDBI Mobile Banking Login

One of IDBI Bank’s significant innovations is its mobile banking service. With the IDBI Go Mobile+ app, customers can access a wide range of banking services from the comfort of their smartphones. The app is easy to use, secure, and comes with various features.

How to Log In to IDBI Mobile Banking

- Download the IDBI Go Mobile+ App: The app is available on both iOS and Android platforms. Simply download it from your respective app store.

- Register for Mobile Banking: After downloading, you will need to register by providing your account details and setting up a secure PIN or password.

- Log In: Once registered, you can open the app and enter your User ID and PIN/password to access your account.

- Explore Features: The app allows you to check balances, transfer funds, pay bills, and much more—all from your phone

IDBI Bank Product and Service Portfolio

IDBI Bank has a diverse portfolio of services, catering to the varied needs of individuals, businesses, and corporate clients. Below is an overview of some of its key offerings:

- Savings and Current Accounts: IDBI Bank offers various savings and current accounts, each tailored to meet different customer needs. These accounts come with attractive interest rates, online banking features, and easy accessibility through branches across India.

- Loans: The bank provides a wide range of loan products, including personal loans, home loans, car loans, and business loans. The loan process is customer-friendly, and IDBI offers competitive interest rates along with flexible repayment options.

- Credit Cards: IDBI Bank issues credit cards with various reward structures. Customers can benefit from cash-back offers, discounts on dining, shopping, and fuel, and attractive reward points that can be redeemed for gifts and travel.

- Insurance: Through strategic tie-ups with leading insurance companies, IDBI Bank offers a wide range of life, health, and general insurance products. These plans are designed to safeguard customers against unforeseen events while providing financial security.

- Investment Services: IDBI Bank also provides wealth management and investment services. It offers mutual funds, fixed deposits, and investment schemes such as the Sovereign Gold Bond (SGB), which we will explore later in this article.

- Internet and Mobile Banking: To enhance customer convenience, IDBI Bank has robust digital banking platforms, including internet and mobile banking services. These services enable users to manage their finances, make transactions, and pay bills at their convenience, from anywhere in the world.

IDBI Bank Account Number Digits

IDBI Bank provides all customers who wish to open a savings account with a unique 12-digit IDBI Account Number to facilitate all services.

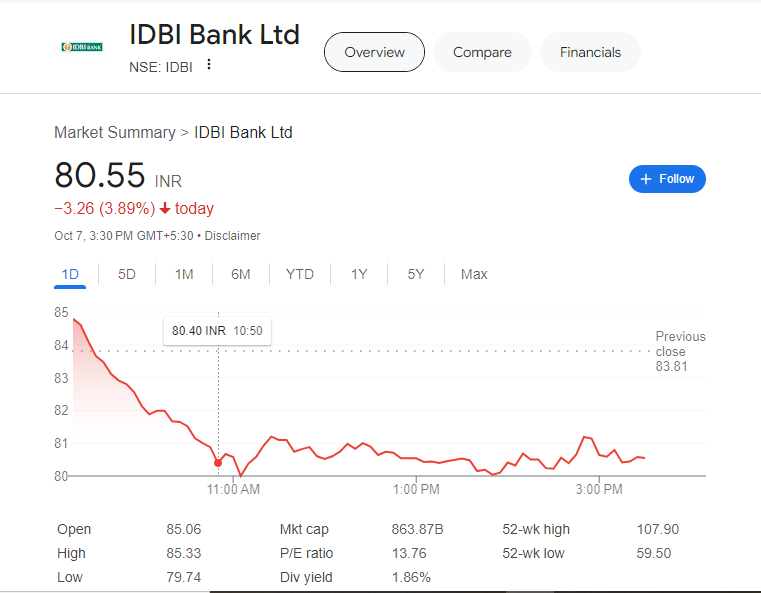

IDBI Bank Share Price

As of October 7, 2024, the IDBI Bank share price stands at ₹80.38. Over recent months, the stock has experienced fluctuations, with a low of ₹79.74 and a high of ₹89.00 in the past few weeks. The stock has shown significant growth over the past year, with a 51.13% increase in value, reflecting improved investor confidence and the bank’s strategic initiatives.

Investment Opportunities with IDBI Bank: Sovereign Gold Bonds

IDBI Bank offers an attractive investment option in the form of Sovereign Gold Bonds (SGBs), which are issued by the Government of India and managed by the Reserve Bank of India. These bonds are a secure, tax-efficient, and profitable way to invest in gold without dealing with the risks associated with owning physical gold.

Why Invest in Sovereign Gold Bonds?

- Safety and Sovereign Backing: The bonds are issued by the Reserve Bank of India on behalf of the government, making them one of the safest forms of gold investment.

- Capital Appreciation: Investors benefit from potential capital gains if the price of gold rises during the bond’s tenure.

- Fixed Interest: SGB investors receive a fixed annual interest rate of 2.50%, payable semi-annually, in addition to capital appreciation.

- Flexible Tenure: The bonds have a tenure of 8 years, with an option to exit after the fifth year.

- Liquidity: SGBs can be traded on stock exchanges if held in Demat form, providing liquidity to investors.

- Purity: Each bond represents 1 gram of 999 purity gold.

- Tax Benefits: SGBs offer tax exemptions on capital gains upon redemption, and TDS is not applicable. Long-term capital gains also qualify for indexation benefits.

Upcoming Sovereign Gold Bond Tranches for 2024:

| Sr. No. | Tranche | Subscription Period | Date of Issuance |

|---|---|---|---|

| 1 | 2023-24 Series III | December 18 – 22, 2023 | December 28, 2023 |

| 2 | 2023-24 Series IV | February 12 – 16, 2024 | February 21, 2024 |

Features of Sovereign Gold Bonds

- Product Name: Sovereign Gold Bond Scheme 2023-24

- Eligibility: Open to resident individuals, Hindu Undivided Families (HUFs), trusts, universities, and charitable institutions.

- Denomination: Bonds are denominated in multiples of 1 gram of gold.

- Tenure: 8 years, with an exit option after 5 years.

- Maximum Investment: 4 Kg for individuals and HUFs; 20 Kg for trusts.

- Issue Price: Based on the average price of gold (999 purity) over the last three working days before the subscription period.

IDBI Bank Customer Care Number

IDBI Bank Customer Care Number: 00 91 22 6771 9100

FAQs About IDBI Bank

Q1) Are IDBI Nationalised banks in India?

Ans:- There was no nationalization of IDBI. IDBI was founded as a subsidiary of the Reserve Bank of India. The government of India acquired the shares. IDBI Bank Ltd was formed with LIC subscribing a significant part of its shares.

Q2) How to check the account balance in IDBI Bank?

Ans:- Your bank balance can be checked by calling 1800-843-1122 from your registered mobile number. The balance of your account will be sent to you via message.

Q3) Is IDBI Bank safe?

Ans:- We at IDBI Bank take a number of steps to ensure the safety and security of our customers’ online transactions.

Conclusion

IDBI Bank The India Development Bank, commonly referred to as IDBI, is one of the most prominent financial institutions in India, with a rich heritage, well-rounded business practices, and a commitment to providing effective banking solutions to Indians.