Meezan Bank is a pioneer in the banking sector with a wide range of Shariah-compliant financial products and services catering to the needs of individuals, businesses, and corporations in the country. The purpose of this article is to examine the features, products, and services offered by Meezan Bank.

Meezan Bank

Meezan Bank is Pakistan’s pioneer and largest Islamic bank, operating under the principles of Islamic finance, which forbids interest and promotes ethical, socially responsible banking.

Founded in 2002, Meezan Bank provides a comprehensive range of Shariah-compliant products and services to meet the financial needs of individuals, businesses, and corporations. These offerings include current accounts, savings accounts, and term deposits, all in line with Islamic banking principles.

Read Also: IDBI Bank

Meezan Bank Online account opening

Meezan Islamic Bank provides an online account opening service, enabling customers to easily open their accounts from the comfort of their homes. Follow these general steps to open a Meezan account online:

- Go to the Meezan website to learn more.

- Choose the type of account you would like to open.

- Complete the online application form.

- Please upload the required documents.

- Ensure that the application is reviewed and submitted.

- Verification and approval are awaited.

- Activate your account by following the instructions.

Meezan Bank Online

Meezan Islamic Bank provides online banking services, allowing customers to manage their accounts and carry out various banking transactions through digital platforms. Here are some essential details about meezan’s online banking services:

- Internet Banking: Pay bills, transfer funds, and access accounts online.

- Mobile Banking App: Access your bank account using iOS and Android devices.

- Account Management: Create accounts and update personal information.

- Fund Transfers: The transfer of funds between bank accounts and to other banks.

- Bill Payments: Pay utility bills and credit card bills conveniently.

- Account Statements: Online account statements are available for viewing and downloading.

Meezan Bank Roshan Digital Account

The Meezan Bank Roshan Digital Account is a dedicated banking service tailored for overseas Pakistanis, allowing them to efficiently handle their financial transactions and make investments in Pakistan with ease. Key highlights include:

- Purpose: Facilitates overseas Pakistanis’ financial and investment activities in Pakistan.

- Account Types: Offers PKR and foreign currency Roshan current and savings accounts.

- Features: Fund transfers, bill payments, investment opportunities, and attractive profit rates are some of the services offered online.

- Investment Options: Shares of PSX companies, Certificates of Naya Pakistan, and Mutual Funds of Meezan Bank.

- Online Account Opening: You can open an account online through Meezan Bank’s website.

- Benefits: Simple procedures, no minimum balance requirement, fund repatriation, and economic contribution to Pakistan.

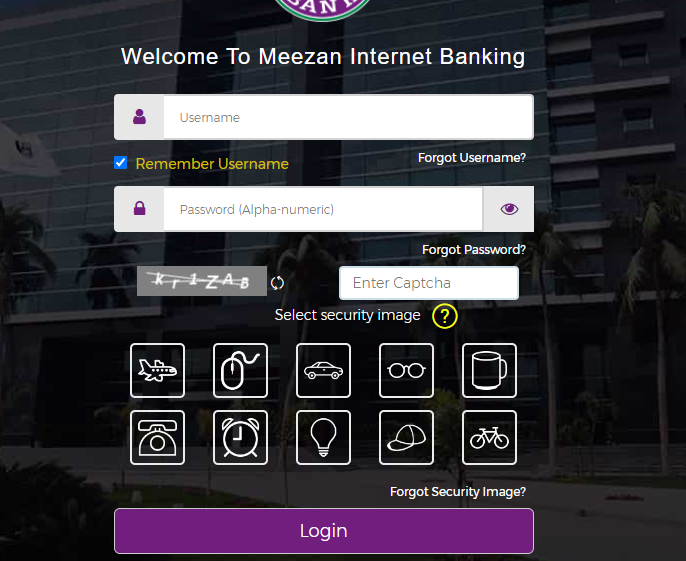

Meezan Bank Login

Follow some Steps:

- Visit the official Meezan Bank Website.

- Enter your Username.

- Enter your Password.

- Please enter captcha.

- Please select your Security image.

- Please click on the Login Button.

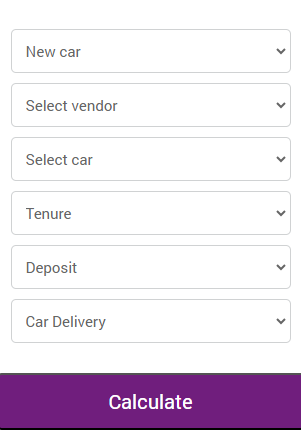

Meezan Bank Car Loan Calculator

Follow these Steps:

- Visit the Official Meezan Bank Calculator website.

- Select the New car option.

- Please select vonder.

- Please select a car.

- Please select Tenure.

- Please select Deposit.

- Please Choose car delivery.

- Please click on the “Calculator” Button.

Meezan Bank Profit Rates

Meezan Bank offers a variety of profit rates on its savings accounts, including the Roshan Digital Account (RDA), which are aligned with Islamic banking principles. As of October 2024, profit rates depend on the account type and investment duration.

Meezan Bank Branches Phone Number

Meezan Bank – Civil Hospital Road Branch

- Phone NO. :+92 21 111 331 331

Meezan Bank – Satellite Town Branch

- Phone NO.+92 21 111 331 331

Meezan Bank – Airport Road Branch

- Phone NO.+92 21 111 331 331

Advantages of Meezan Bank

| Advantages | Details |

|---|---|

| Shariah Compliance | The biggest advantage of Meezan Bank is its adherence to Islamic finance principles. This makes it a preferred choice for customers seeking ethical and interest-free banking. All products are vetted by Shariah scholars to ensure compliance with Islamic law, which gives confidence to customers looking for Halal financial solutions. |

| Wide Range of Shariah-compliant products | Meezan Bank offers a broad spectrum of services, including savings and current accounts, car financing (Ijarah), home financing, and investment opportunities through Mudarabah-based products. This allows customers to have a variety of options while staying within the bounds of Islamic principles. |

| Digital Banking Services | The bank has embraced technology and provides robust online banking solutions. Whether it’s internet banking, mobile banking apps, or online account opening, customers can manage their finances remotely with ease, improving convenience. |

| Roshan Digital Account for Overseas Pakistanis | Meezan Bank’s Roshan Digital Account (RDA) is a major advantage for overseas Pakistanis, enabling them to open accounts, manage finances, and invest in Pakistan from anywhere in the world. This has greatly simplified the banking experience for expatriates looking to contribute to Pakistan’s economy. |

| Customer Support and Branch Network | Meezan Bank has over 900 branches spread across the country, ensuring that it’s accessible to customers everywhere. Additionally, its customer support through helplines and digital platforms offers prompt assistance for any queries or issues. |

| Profit-Based Returns | Instead of interest-based earnings, Meezan Bank provides customers with profit-sharing options in savings accounts and investments. This profit-sharing model allows customers to earn Halal returns on their savings while adhering to Islamic law. |

| Islamic Financing Options | For those looking for loans or financing solutions that are Shariah-compliant, Meezan Bank offers products like Car Ijarah (car financing) and Diminishing Musharakah (home financing), providing customers with Halal alternatives to conventional interest-based loans. |

Disadvantages of Meezan Bank

| Disadvantages | Details |

|---|---|

| Limited Profit Rates Compared to Conventional Banks | Although Meezan Bank provides Shariah-compliant profit rates, they are often lower than the interest rates offered by conventional banks. This might be seen as a disadvantage for customers seeking higher returns on their investments. |

| Limited Global Presence | Meezan Bank’s international services are primarily limited to overseas Pakistanis through the Roshan Digital Account. However, unlike some global banks, Meezan doesn’t have a significant international branch presence, which could limit accessibility for non-resident Pakistanis outside the RDA services. |

| Fewer Conventional Loan Options | As Meezan Bank strictly follows Islamic finance principles, it does not offer conventional loan options such as personal loans, interest-based home loans, or credit cards with interest. For customers looking for such products, Meezan Bank may not be the ideal option. |

| Strict Shariah Regulations | Meezan Bank’s commitment to Shariah compliance is an advantage for those seeking Islamic banking, but for others, the strict adherence to these principles may limit flexibility. For example, customers may face certain restrictions on investment options or financing that would be available in conventional banking. |

| Processing Time for Shariah Audits | Meezan Bank conducts regular Shariah audits to ensure that its products and services are compliant with Islamic law. While this is essential for maintaining integrity, it can sometimes slow down the approval process for certain products, making it less efficient than conventional banks where approvals might be faster. |

| Limited Investment Opportunities in Foreign Markets | Meezan Bank’s investment options, while Shariah-compliant, are generally focused on the Pakistani market. For customers interested in investing in international markets or global portfolios, Meezan Bank may offer limited options compared to other banks that provide global investment services. |

| Higher Down Payment for Financing | Islamic financing products like Ijarah (car financing) or home financing often require a higher initial down payment compared to conventional interest-based loans. This may be a drawback for customers who prefer lower upfront costs. |

Meezan Bank Helpline

- Call Center: +92 (21) 111-331-331 & +92 (21) 111-331-332.

- Websites: www.meezanbank.com & www.meezanbank.pk.

- Email: complaints@meezanbank.com.

- Fax: +92 (21) 36406023.

FAQs About Meezan Bank

Q1) Is Meezan Bank profit halal?

Ans:- COIIs are Mudarabah-based deposit products through which you can invest your savings for one year and receive Halal profits.

Q2) Can a Meezan Bank account be opened online?

Ans:- Meezan Digital Account Opening App makes opening a Meezan Bank Account simple, secure, and safe.

Q) What is Meezan’s daily income plan?

Ans:- Timeline photos taken on Sep 12, 2021. “Meezan Daily Income Plan-I (MDIP-I)” is an Allocation Plan under “Meezan Daily Income Fund (MDIF)” that aims to provide investors with a competitive rate of return through investments in Shariah-compliant fixed-income instruments.

Conclusion

The Meezan Bank in Pakistan has established a reputation for being an example of excellence in the banking sector by providing customers with a wide variety of Shariah-compliant financial products and services.